Corporate taxes in Montenegro

Open an account without coming to Montenegro

Montenegro company registration steps without visiting Montenegro

Deadline for harmonization of operations with the new Law on Companies of Montenegro

Few things to know before starting a business in Montenegro

Montenegro Citizenship by Investment Program

A step-by-step procedure for setting up a new Montenegro company

PROGRAMS FOR IMPROVING THE COMPETITIVENESS OF THE ECONOMY

TAX SYSTEM AND INCENTIVES

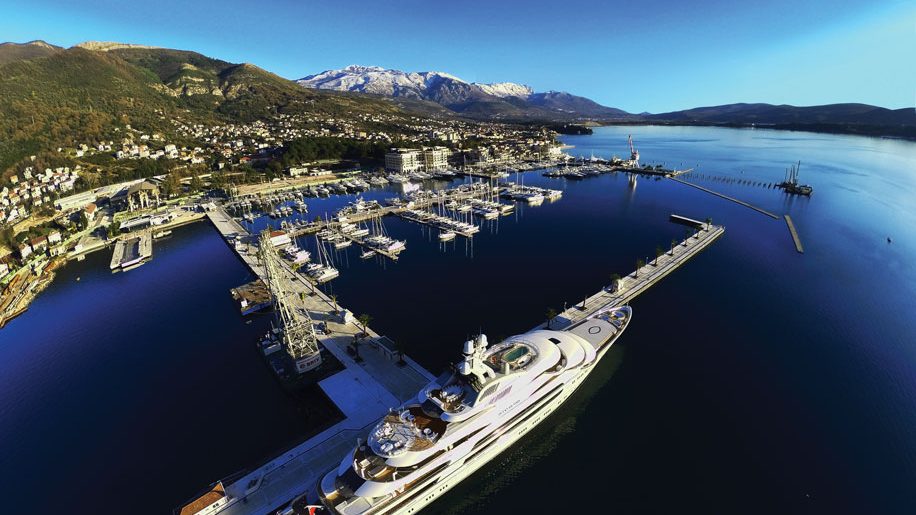

WHY INVEST IN MONTENEGRO

MONTENEGRO AT A GLANCE

Registering a branch office Montenegro

Legal Structure of a Monteengro Company

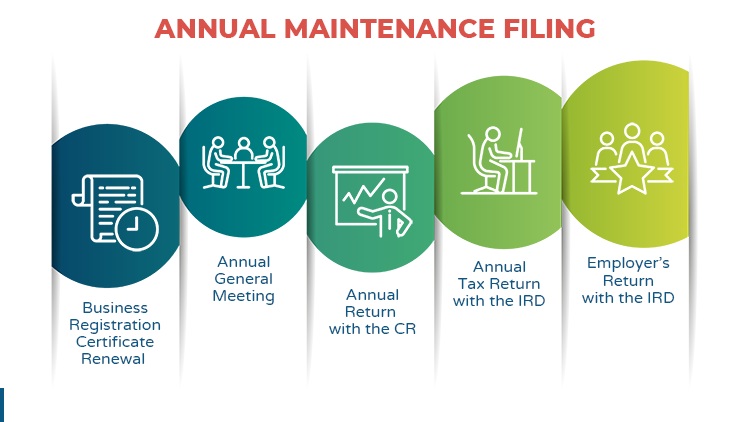

Annual Filing Requirements for Montenegro Companies

Compliance requirements for a Montenegro company

First Steps After Company Registration

FAQ

Representative Office Registration

Subsidiary Company Registration in Montenegro

Foreign Company Registration in Montenegro

Guide to incorporating a local Montenegro company

Company business forms in Montenegro

How to open a branch in Montenegro

Opening a company bank account in Montenegro

Low taxes in Montenegro

Benefits for Montenegro Residency

Temporary Residence for Employment

Temporary residence permit for property owners

Visa and residence permit in montenegro

On line registration company

On line registration procedure company could be done without your presence in Montenegro:

Quick and easy – 3 steps without travel:

You need to send us, by post, copy of your passport (page with your photo) – verified by Public notary in your country; then, the Authorization letter – verified by your Notar, too (we send you the form for that letter); and documents for opening an account for firm/company in bank in Montenegro, Podgorica (we send you that, so you could sign it).

So, all of these documents, after you sign it and do what’s needed with Public notary, you sending us by post.

Than we finish the Registration here and send you by post all papers and documents when it’s finished (of course, you send us Name of future firm. Also, predominant activity, main activity which firm will be doing.)

Service for complete registration is 950€.

If you need some more info, e-mail us: selecta.me@gmail.com

Mob: 00382 69 590 433

If you need some more info, e-mail us selecta.me@gmail.com

La costituzione della società in Montenegro

Company Liquidation in Montenegro

How can you draw-up a residence permit in Montenegro?

Starting a Business in Montenegro

The List of the Banks we work with

The List of the Banks we work with

If you need some more info, e-mail us selecta.me@gmail.com

Mob: 00382 69 590 433

Why Register A Company In Montenegro

Why Register A Company In Montenegro

For people wanting to start a new business, Montenegro is a smart choice.

Montenegro offers great tax incentives due to its favourable tax regime and its wide network of double tax treaties.

- Currency : EUR

- Government : republic

- Unemployment rate : 14.70%

- Corporate income tax : 9%

- VAT (basic rate): 19%

- VAT (decreased rate): 7%

- Tax return : yearly

- Dividend tax : 9%

- Types of company: Limited liability company, Joint-stock company

- Registered capital : Limited liability company, 1 EUR, Joint-stock company, 25000 EUR

- Incorporation process duration : 7 – 14

These tax incentives together with so many other incentives offered by Montenegro, render Montenegro the ultimate international business centre of our planet!

Investors may freely transfer money into Montenegro, and freely transfer money out of Montenegro, without restrictions.

Montenegro offers a basket of incentives including the low tax on the net profits and the

double tax treaties.

We will guide you through the process of registering your company and establishing your registered identity.

Complete and submit our application form online.

In providing this information, it is our prime intention to contribute to the effort of Montenegro to become an even more successful international business centre for the benefit of foreign investors and to the Montenegro economy.

If you need some more info, e-mail us selecta.me@gmail.com

Mob: 00382 69 590 433

http://www.eliaschristofi.com/en/how-register-company-cyprus-kipr-offshore

Representative Office Montenegro

Representative Office Montenegro

Like in any other country, a representative office provides a presence in Montenegro, to promote your company and your products

What’s the cost of a Representative Office in Montenegro?

As usual, it depends from your goal – do you want to impress your customer with an luxurious office in downtown Podgroica? Or a virtual office is enough? However some basic rules are always true.

Knowing the bureaucracy I strongly suggest to use a consultant if you can afford it. Price depends but I believe that they will not charge less than Eur 500 including setup taxes.

You need a registered address in Montenegro. You can rent an office, but the law allows using a cheaper virtual office as well.